Baldwin County Commission Expected To Vote On Property Tax Increase Wednesday

Summary

The Baldwin County Commission is holding its final hearing Wednesday morning on a proposed property tax increase. Commissioners are then expected to vote on the proposed 8.9% increase. During a September 1st public hearing, Assistant County Manager Dawn Hudson talked […]

The Baldwin County Commission is holding its final hearing Wednesday morning on a proposed property tax increase.

Commissioners are then expected to vote on the proposed 8.9% increase.

During a September 1st public hearing, Assistant County Manager Dawn Hudson talked about some of the increasing costs for the county.

The biggest new item for the county is covering the $637,000-a-year fire services contract that the State of Georgia is no longer paying for to cover the Central State Hospital area.

The county is suing the state over the contract.

Other increases include costs for the state’s new election mandates ($100,000 a year), body cameras and Tasers for sheriff’s deputies ($100,000 a year) and a subsidy for EMS ($195,000 a year).

Hudson also talked about a general 3% to 5% increase for the cost of supplies like fuel, asphalt and utilities.

The property tax increase will produce about $1 million a year. Hudson says a $100,000 home would see a tax increase of $26 for a local resident.

During that same hearing, Commission Chair Henry Craig talked about the proposed increase.

A number of residents came to the hearing to oppose the proposed increase. Some raised questions on county spending including on the new county government building and the airport.

Later in the hearing, Chairman Craig said if the Commission does not pass the increase, it would have to look at cutting the county’s discretionary budget.

The last county property millage rate increase was in 2014.

The proposed property tax increase only affects the county portion of a resident’s property tax bill. Not the school board portion. It also does not affect the city portion for those who live inside Milledgeville city limits.

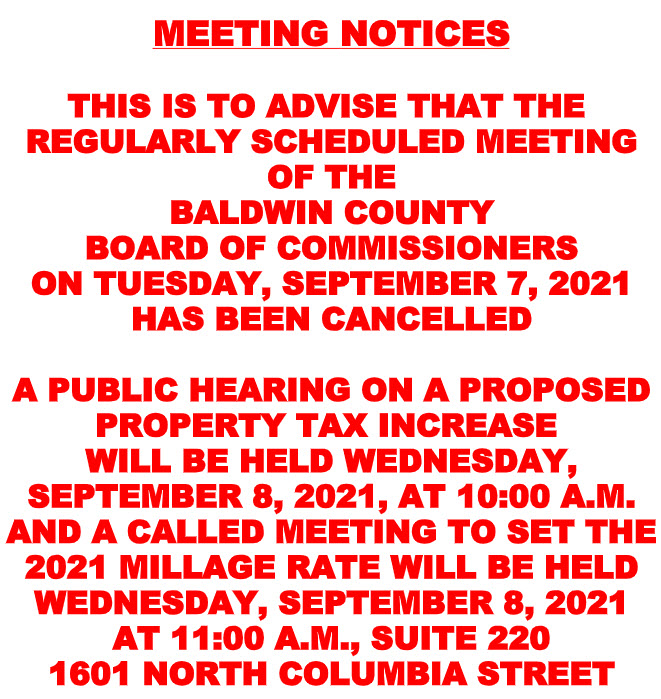

The final public hearing is 10 a.m. at the Baldwin County Government Building, It will be followed by an 11 a.m. County Commission meeting to set the new millage rate.

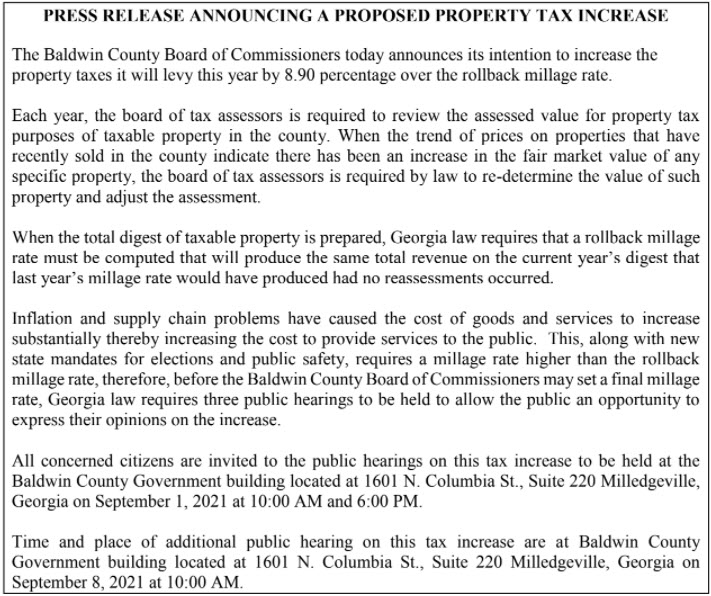

Here are the final two public notices for the proposed property tax increase.

I hope when the next election the crooks will be voted out look like we are paying enough taxes that Baldwin county already getting from people that state of Georgia does not want to help with all they doing is taxing the people that lives in Baldwin County to death and want more got to stop its a dam shame